Financial planning and investing with us

Successful Corporate Real Estate Investment (CREI)

We are recognised by well-known industry associations and independent publications as a leader in real estate, both for our business achievements and our passion for innovation.

Real Estate Investment is a crucial part of our personal and corporate lives. However, its importance is never emphasized and the approach to Corporate Real Estate Investment is, at the most, done on an ad-hoc basis and usually not based on a structured process.

Considering the magnitude of such an investment, the foray into Real Estate Investment by any corporation needs serious thought and also a structured process. Below we outline the necessary steps for Corporations to consider in embarking in the exciting world of Real Estate Investments.

To take the first cohesive step into Corporate Real Estate Investment is of course research. One will need to be comfortable with the performances of a particular sector in terms of demand, supply, trends and forecasted performances. The research must also establish the yields performances to give an idea of the expected returns and also the cost of acquisition and ownership.

The purpose of research is also to set a base for the next step which is to establish the investment objectives. Objectives can be divided into two sections, at the corporate level and at the operational level. At the corporate level, a decision must be made on whether property is going to be the core or the supplement/diversification towards the revenue and performance of the company and whether it is property investment or development. At operational level, the nuts and bolts are decided upon such as:

- The sectors to be invested in

- Type of properties to invest in

- Amount of Exposure in each sectors

- Benchmarked Yields and Operational Costs for each sector

- Holding period for each type of properties

- Financing Options and Models

- Competency Levels and Management Team Required

At the end of the first two steps, you should have determined the core area of focus your corporate real estate investment, i.e. what are your options, what is appropriate for your organization and what you organization is capable to invest in.

After you have clearly defined what you want to invest in, the next step is of course sourcing the properties. The easiest and the most cost effective way is of course via Real Estate Agents who are generally appointed by the Vendors to seek our organizations that are looking for property investments. It is best to inform a couple of Real Estate Agents on your intentions and to provide them with some information on your investment requirements.

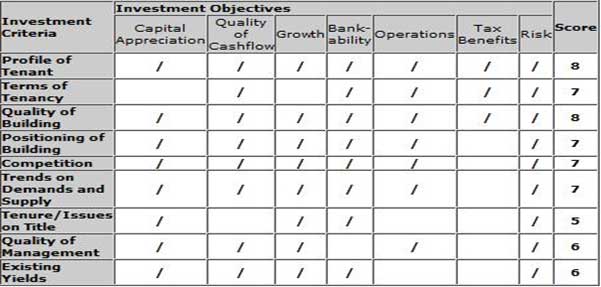

Proposals will come in thereafter and for the next step which is the initial review, we suggest using a decision making matrix to decide whether to proceed further. A sample of this matrix as prepared for one of our corporate clients based on their investment objectives and criteria is appended. Only if the matrix provides a percentage above a pre-determined level (usually above 70%) then do we move to the next level, i.e. a detailed analysis.

In this detailed analysis, all the matters pertaining to the proposal is thoroughly reviewed including title matters, yields, anticipated growth, tenancy terms and schedules, management contracts etc. Some of this information is usually made available upon a letter of intent and confidentiality is made to the vendors and the rest via market research and investigation. This can either be done in house by the investment team or outsourced to Real Estate Agents and Property Consultants alike.

The initial review was excellent and the detailed analysis shows that the investment is not only viable but suits the company’s risk and investment profile very much. The next step is of course seeking approval from management to proceed with the negotiations and to pre-determine the threshold levels. Upon management approval, we move to the most exciting stage of Corporate Real Estate Investment, Negotiations.

As mentioned, this is the most exciting part of the whole process. Most of the time in the Real Estate market there is no fixed manner in which negotiations take place. The preferred manner is to first generally agree on the salient terms and conditions and then for either the Vendor or the Purchaser to make an offer to the other party to accept. The toughest part is of course the general agreements. Issues to content with include the price, terms of payment, date of completion, conditions precedent, treatment of deposits with stakeholders etc.

This is the longest step in terms of time as it about closing the Deal. Once the offer is accepted, deposits will be paid to the Real Estate Agents as stakeholders and thereafter, the sale and purchase agreements will be drawn out to be executed. Upon execution of the sale and purchase agreements, the balance deposits are paid (usually up to 10% of the sale price) with the balance to be paid upon completion of the sale (i.e. upon fulfillment of conditions precedent). Thereafter there will be a handover date for the purchaser to take possession of the building and that concludes the deal. From then on, Management takes over.

The process of getting started into Corporate Real Estate Investment is definitely challenging. Though real estate investment has a lot of the upside, caveat emptor as real estate investment has also its fair share of drawbacks, the main being:

- Real Estate investment has a high cost of entry and ownership

- Real Estate investment offers less liquidity as compared to equities

- Real Estate investments generally require a long holding period

With this in mind, it is always good to back up your Corporate Real Estate Investment decisions with sound research, structured decision making process and reliable advice.

Sample of Corporate Real Estate Investment Decision Matrix

Innovation in Real Estate Marketing

A Real Estate Agent’s Perspective

Developing a product innovation

- Problem: Being in a comfort zone without any room for change.

- The problem is not knowing how to get new innovative thoughts into your mind, but how to get old ones out. (eg. Dee Hock – business visionary and creator of Visa)

- The problem is not about learning but about forgetting.

What it isn’t.

- Real Estate Marketing?

- Not to be seen as the task of finding clever ways to sell the properties.

- Not to be seen and confused with the sub-functions of marketing I.e. advertising and good salesmanship

- It is not the art of Selling what you develop i.e. production concept is out of the window!!!

What is innovative real estate marketing?

- It is the art of knowing what product to develop.

- It is the art of identifying and understanding customer needs and creating/developing real estate products that deliver these needs which the customer is willing to pay for.

- It is the art of developing the marketing channels required to reach the desired target market.

How innovative real estate marketing works.

- It is to be treated like the marketing management of any other product. The following needs to be determined:

- Consumer and Market Analysis

- Competitor Analysis

- Channel Development

- The 4Ps – Product, Price, Place, Promotion

- From Strategy to Tactics

- Exclusive appointment to build channels that last.

- Targeted Direct Mailers – Regular mail and e-mails to net communities and target markets.

- Pricing and innovative promotions to position the property

- Editorials in targeted press i.e. business magazines, business sections etc, Branding the building via a name to proliferate the building and what it stood for.

- A successful property development usually sees market leading and market driven products.

- The decision on the Product is the most critical. The other elements are of course the remaining 3 Ps: Price, Place – choice of distribution channels and Promotions – advertising, personal selling, public relations, publicity and direct selling.

- But HOW do you develop a product?

- Channel Development

- To build product trust with consumers

- Direct to buyer /end user

- The Marketing Mix

- Product. Needed a product that will appeal to the affluent target market.

- An available ‘Marketing Gap’ as recognized.

- A ‘lifestyle’ concept to be used as the product’s main driving force, but choice of lifestyle should be innovative. Any landmark building in the area or view of a park could be used as the primary focus. However:

- Fundamental issues always need to be considered very important. i.e. size, layout, finishes, orientation, views, M&E etc

- Main focus is ‘lifestyle’ and how the units can sustain it.

- Pricing. To reflect the lifestyle, to attract those who appreciate the lifestyle, yet to remain competitive with competitors in the surrounding location.

- Place. Target market very well defined – 28-45 years old, professionals, business people who enjoy and cherish their lifestyle

- Promotion. Use the print medium and electronic media to attract the target market. Also organized talks and seminars on the development.

So What is Innovative Real Estate Marketing?

- Creating a product that meets the requirements of the consumer.

- Creating the channels to ensure the product reaches the consumer.

- Creating the awareness of the channel and the availability of the product.

- And most important, forgetting past successes and creating solid foundations for new ways to do the same things.

Bonus – Product Development & Foreseeable Trends

- The character of the development must start from some perceivable element and is gradually built up by a composite of other complementing factors such as quality, management and layouts.

- This perceivable element can be in the architectural styling of the development, the layout of the properties or some other element that is strong enough to leave a lasting mark in the minds of purchasers.

- These developments must also have an ambience that is well thought out. The ambience in demand now is something elegant yet simple.

- We also anticipate tropical (not to be read as Balinese) designs to be a long-term sustaining ambience concept. In addition, well designed landscaping that will take advantage of the land profile and layouts must be evoked and implemented. The landscape content must appear quite ‘natural’ rather than manicured.

Bonus – Product Development & Foreseeable Trends

- Other critical success factors include:

- Low density. (or appearance of low density)

- High privacy and security.

- Ample facilities and amenities.

- Efficient, functional and spacious layouts.

- Quality finishes and fittings. (do not mistake quality for being expensive)

- Quality of the detailing and construction of the building.

- The property manager’s reputation and the anticipated quality of the management and maintenance of the building/development.

Bonus – Product Development & Foreseeable Trends

- The trend of building lifestyle homes is to stay.

- Developers are still offering houses instead of homes need to seriously rethink of holistic approaches towards fulfilling the needs of the more discerning crowd. Deciding on the right product is definitely challenging and with this in mind, it is always good to back product decisions with ample information, a structured decision-making process and reliable advice.